Electronic Identification and Verification Solution

In the era of Industry 4.0, eKYC solutions are considered among the services adopted by banks to attract customers. Accordingly, eKYC also serves as a solution to shorten verification time, save time and costs, and enhance the operational efficiency of banks.

Outstanding Characteristics

Each request is processed in under 5 seconds. Users can complete the entire eKYC verification process within just 2 to 3 minutes.

Each request is processed in under 5 seconds. Users can complete the entire eKYC verification process within just 2 to 3 minutes.

A super lightweight SDK under 50MB, integrating client-side AI to guide user interactions. Customizable in terms of logo, text, and brand identity.

A super lightweight SDK under 50MB, integrating client-side AI to guide user interactions. Customizable in terms of logo, text, and brand identity.

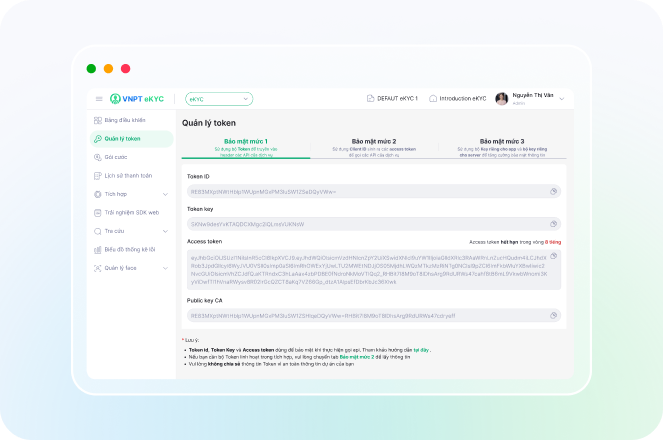

Three security levels for selection. The 3-layer server-to-server security model minimizes the risk of unauthorized access.

Three security levels for selection. The 3-layer server-to-server security model minimizes the risk of unauthorized access.

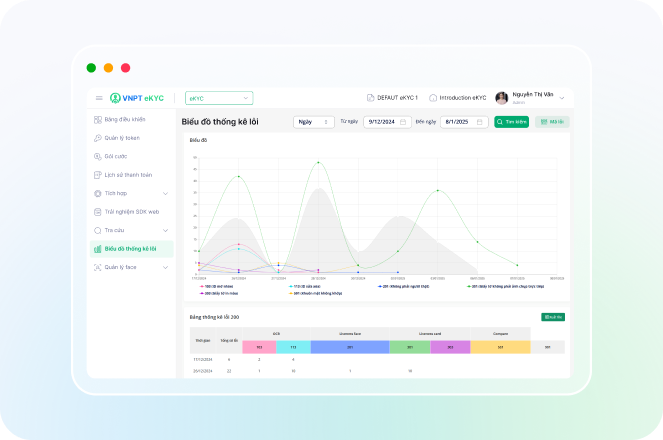

Provides intuitive dashboards for monitoring and analyzing eKYC transactions, enabling process optimization and early detection of abnormal cases.

Provides intuitive dashboards for monitoring and analyzing eKYC transactions, enabling process optimization and early detection of abnormal cases.

Outstanding Features

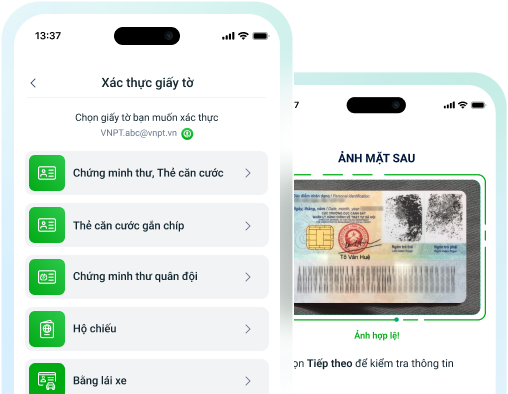

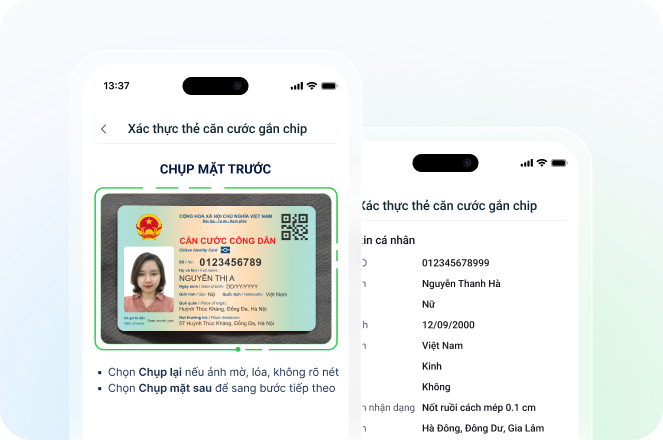

Detection of Invalid Documents

Detection of blurred, damaged, cropped, or tampered documents

Detection of blurred, damaged, cropped, or tampered documents

Detection of documents with overlaid portrait photos or expired documents

Detection of documents with overlaid portrait photos or expired documents

Detection of forged documents (e.g. input images that are photocopies or scans of ID cards)

Detection of forged documents (e.g. input images that are photocopies or scans of ID cards)

Logical checks on document information to identify anomalies

Logical checks on document information to identify anomalies

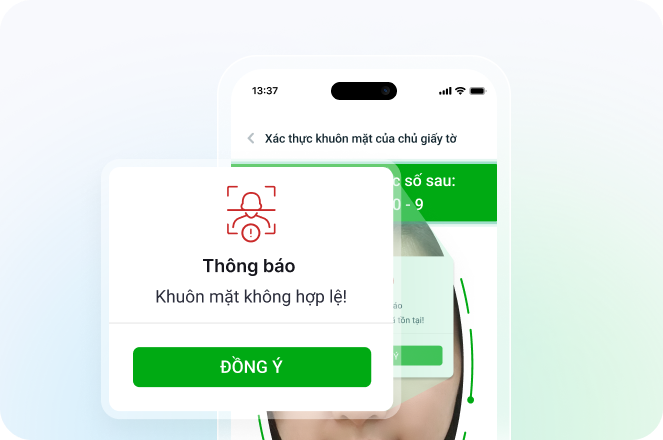

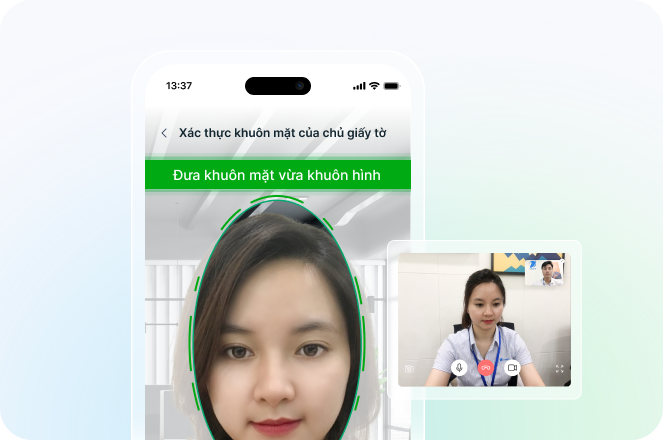

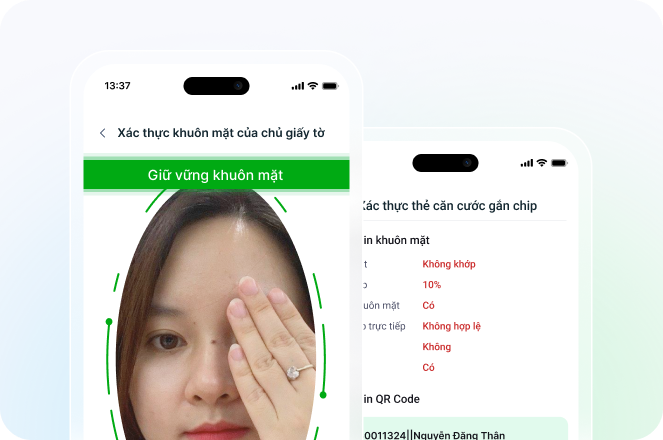

Facial Verification of Document Holders

Only accepts photos taken by customers in real-time

Only accepts photos taken by customers in real-time

Capable of liveness detection to reject fake faces (printed photos, images on electronic screens, 2D/3D masks, and non-human faces)

Capable of liveness detection to reject fake faces (printed photos, images on electronic screens, 2D/3D masks, and non-human faces)

Detects faces that do not meet minimum requirements, such as obscured faces or with closed eyes

Detects faces that do not meet minimum requirements, such as obscured faces or with closed eyes